Investing In Farmland Everything You Need To Know from financialresidency.com

Investing in farmland has become an increasingly popular option for individuals looking to diversify their investment portfolios. With the growing global population and increasing demand for food, farmland can provide stable returns and long-term growth opportunities. However, investing in farmland requires careful consideration and due diligence. In this article, we will explore the steps to invest in farmland in the year 2023.

1. Research and Understand the Market

Before diving into farmland investment, it is essential to conduct thorough research and gain a comprehensive understanding of the market. Familiarize yourself with the current trends, regulations, and potential risks. Consider factors such as location, soil quality, climate, and local farming practices.

2. Set Clear Investment Objectives

Define your investment goals and objectives. Are you looking for stable income, long-term appreciation, or a combination of both? Determine your risk tolerance and time horizon for investment. Clearly defining your objectives will help you make informed decisions throughout the investment process.

3. Seek Professional Advice

Consult with professionals who specialize in farmland investments, such as agricultural economists, land appraisers, and investment advisors. Their expertise can help you navigate the complexities of the market and make informed investment decisions.

4. Assess the Property

Visit potential farmland properties and assess their suitability for investment. Consider factors such as proximity to markets, infrastructure, water availability, and potential for future development. Engage with local farmers and landowners to gain insights into the property’s history and potential challenges.

5. Conduct Due Diligence

Perform a thorough due diligence process before finalizing any farmland investment. This process should include reviewing legal documents, such as land titles and leases, as well as conducting soil tests and environmental assessments. Consider engaging professionals, such as lawyers and environmental consultants, to assist with this process.

6. Consider Investment Vehicles

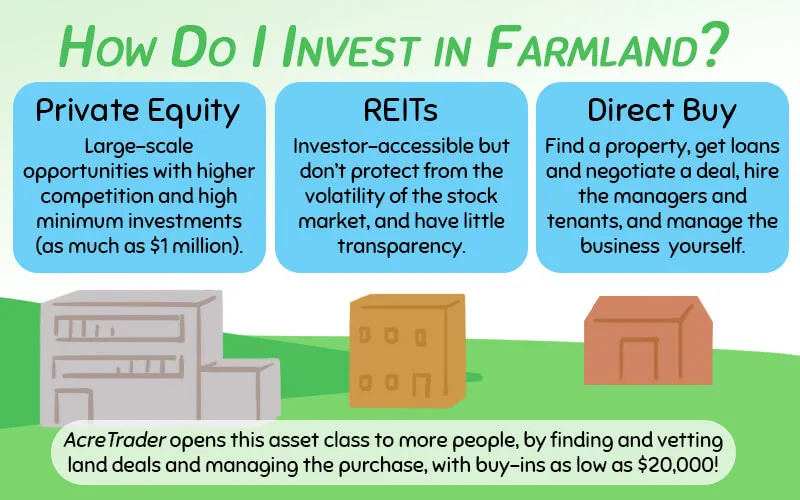

There are various investment vehicles available for farmland investment, including direct ownership, real estate investment trusts (REITs), and farmland funds. Each option has its advantages and considerations. Evaluate the different investment vehicles and choose the one that aligns with your investment objectives and risk appetite.

7. Develop a Risk Management Strategy

Farmland investment involves certain risks, such as weather-related crop failures, market fluctuations, and regulatory changes. Develop a risk management strategy to mitigate these risks. This may include diversifying your investment across different regions or crops, using insurance products, or implementing hedging strategies.

8. Monitor and Manage the Investment

Once you have made your investment, actively monitor and manage it. Stay updated on market trends, regulatory changes, and technological advancements in the agricultural sector. Regularly assess the performance of your investment and make necessary adjustments to optimize returns.

9. Consider Sustainable Farming Practices

With increasing environmental concerns, investing in farmland that follows sustainable farming practices can be advantageous. Consider properties that prioritize soil conservation, water management, and biodiversity preservation. Sustainable practices not only benefit the environment but also contribute to the long-term productivity and value of the farmland.

10. Plan for Succession

If you are investing in farmland for the long term, consider succession planning. Determine how the investment will be managed and transferred to future generations. Consult with legal and financial advisors to ensure a smooth transition and protect the value of your investment.

Conclusion

Investing in farmland can be a rewarding and profitable venture. By conducting thorough research, seeking professional advice, and following a strategic approach, you can make informed investment decisions that align with your objectives. Remember to regularly review and adapt your investment strategy to capitalize on opportunities and manage risks effectively.