One Penny One Stock On Future What Are 2 Ways To Make Money On Stocks from www.socratesperezmd.com

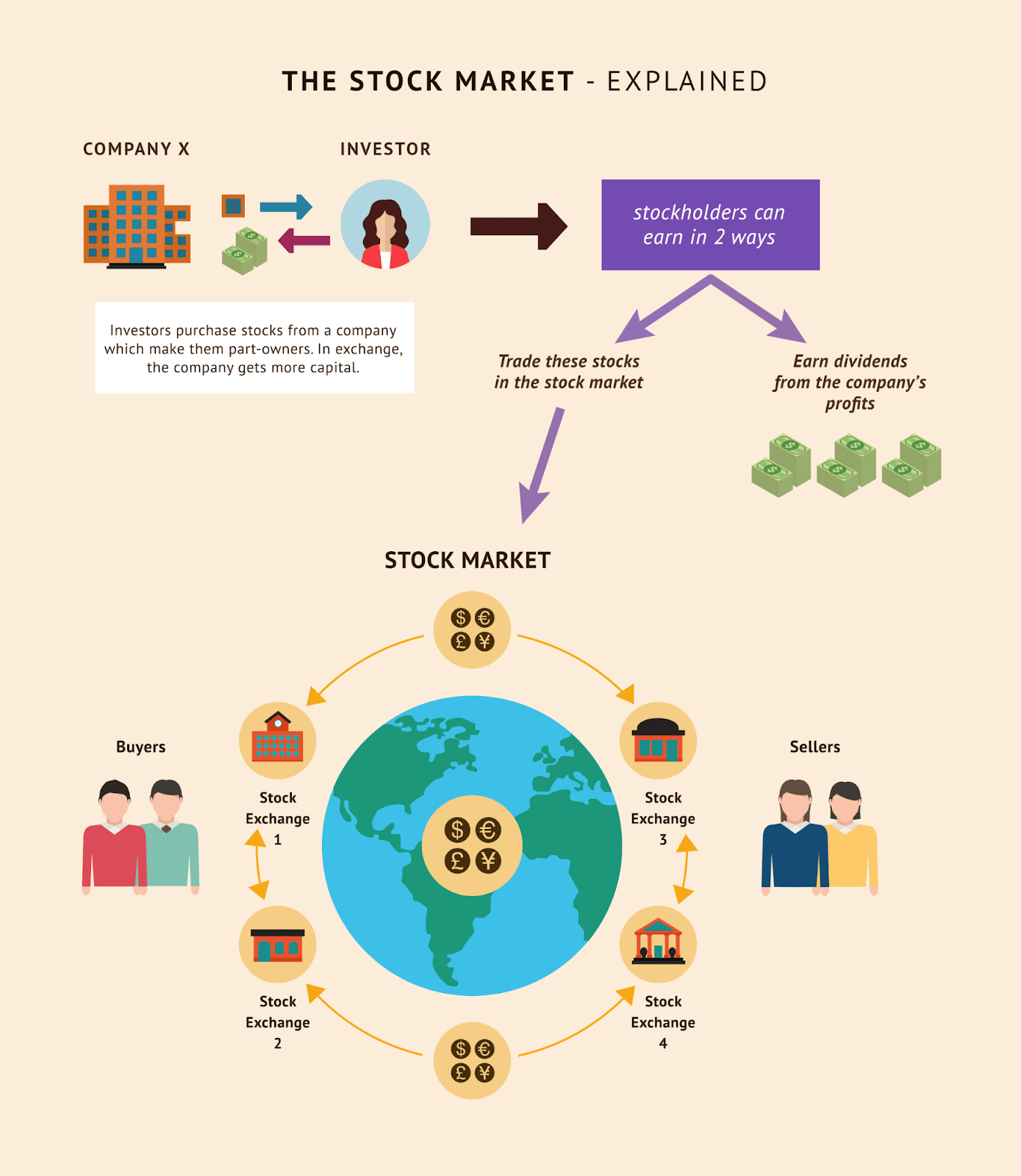

Investing in stocks is a popular way for individuals and companies to grow their wealth. But have you ever wondered how companies make money from stocks? In this article, we will explore the various ways companies generate income through stock ownership and the benefits it brings to both the company and its shareholders.

1. Initial Public Offering (IPO)

When a company decides to go public, it offers its shares to the general public through an Initial Public Offering (IPO). This allows the company to raise capital by selling a portion of its ownership to investors. The funds raised from the IPO can be used for various purposes such as expanding operations, research and development, or paying off debts.

2. Dividends

One of the primary ways companies make money from stocks is through dividends. Dividends are a portion of the company’s profits that are distributed to its shareholders. Companies usually pay dividends on a quarterly or annual basis. The amount of dividend paid per share is determined by the company’s board of directors.

3. Capital Appreciation

Another way companies make money from stocks is through capital appreciation. When a company performs well and its stock price increases, shareholders can sell their shares at a higher price than what they initially paid. This allows them to make a profit, known as capital gains.

4. Stock Buybacks

Some companies choose to buy back their own shares from the stock market. By reducing the number of outstanding shares, the company effectively increases the ownership percentage of its remaining shareholders. This can lead to an increase in the stock price, benefiting shareholders.

5. Stock Options

Companies often offer stock options to their employees as part of their compensation package. Stock options give employees the right to purchase company shares at a predetermined price, usually lower than the current market price. If the stock price rises, employees can exercise their options, buy the shares at the lower price, and sell them at a profit.

6. Financing Opportunities

Owning stocks can also provide companies with financing opportunities. When a company needs additional capital, it can issue new shares to investors through secondary offerings. This allows the company to raise funds without incurring debt or selling assets.

7. Mergers and Acquisitions

Companies can also use their stock as a means of acquiring other companies. Instead of paying cash for an acquisition, a company may offer its own stock as part of the deal. This allows the acquiring company to expand its business while potentially increasing the value of its stock.

8. Debt Conversion

In some cases, companies may have outstanding debt that can be converted into stock. By converting debt into equity, companies can reduce their debt burden and improve their financial position. This benefits both the company and its shareholders.

9. Voting Rights

When individuals or companies own stocks, they often have voting rights in determining the company’s direction. Shareholders can vote on important matters such as electing board members, approving mergers or acquisitions, and making significant business decisions. This gives shareholders the opportunity to actively participate in the company’s decision-making process.

10. Economic Growth

Lastly, when companies make money from stocks, it often indicates economic growth. As companies generate profits and increase their stock value, it contributes to a healthy and thriving economy. This benefits not only the companies and their shareholders but also the overall society.

Conclusion

Companies make money from stocks through various means such as IPOs, dividends, capital appreciation, stock buybacks, stock options, financing opportunities, mergers and acquisitions, debt conversion, voting rights, and contributing to economic growth. Investing in stocks can be a lucrative way for companies to raise capital and for individuals to grow their wealth over time.