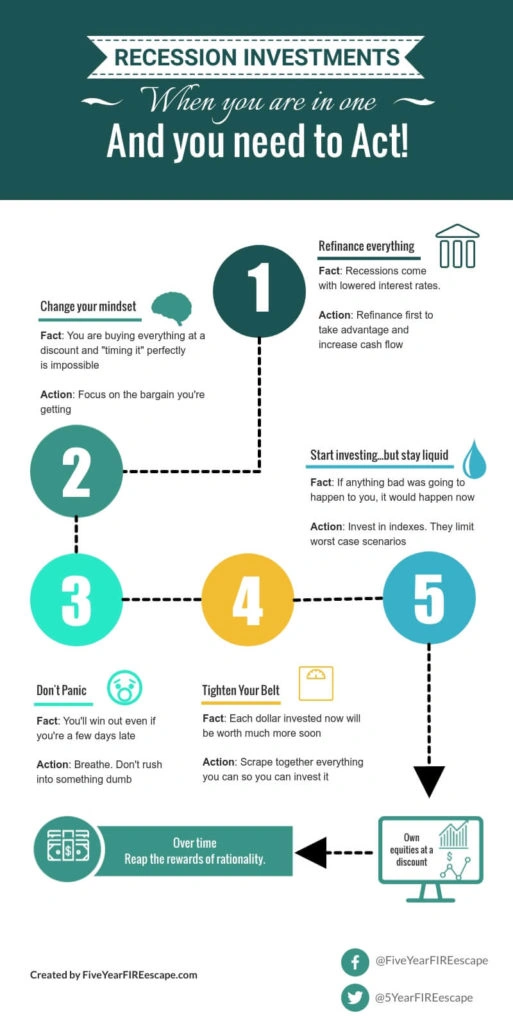

Investing During a Recession 5 Steps for STRESSFREE Investing from fiveyearfireescape.com

In the midst of an economic recession, many people are apprehensive about investing their hard-earned money. However, history has shown that recessions can present unique opportunities for savvy investors. By understanding the market dynamics and implementing the right strategies, it is possible to not only protect your assets but also generate substantial returns during these challenging times. In this article, we will explore some key strategies for investing during a recession in 2023.

1. Diversify Your Portfolio

One of the fundamental principles of investing is diversification. During a recession, this becomes even more crucial. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can mitigate the risk associated with any single investment. This strategy ensures that if one sector or asset class underperforms, the losses can be offset by gains in other areas.

2. Identify Undervalued Stocks

During a recession, stock prices often plummet due to market panic and pessimism. This creates an opportunity to buy high-quality stocks at discounted prices. Conduct thorough research and identify companies with strong fundamentals but temporarily depressed stock prices. Investing in these undervalued stocks can yield significant returns once the economy recovers.

3. Consider Defensive Stocks

Defensive stocks are those that are relatively unaffected by economic downturns. These companies typically operate in sectors such as healthcare, utilities, and consumer staples. During a recession, people tend to prioritize essential goods and services, making these sectors more resilient. Investing in defensive stocks can provide stability and consistent returns even during turbulent times.

4. Invest in Bonds

Bonds are considered safer investments during a recession as they offer a fixed income and are less volatile than stocks. Government bonds, in particular, are seen as low-risk investments. When stock markets are experiencing significant declines, investors often flock to bonds, driving up their prices. This creates an opportunity to purchase bonds at a lower yield, maximizing potential returns.

5. Look for Real Estate Opportunities

Recessions often lead to a decline in real estate prices, making it an attractive investment option. Look for properties with strong rental potential in desirable locations. Rental income can provide a steady cash flow, while the property appreciates in value over time. Additionally, during a recession, there may be distressed sellers who are willing to negotiate lower prices, further enhancing your investment potential.

6. Invest in Quality Mutual Funds

Mutual funds offer a convenient way to diversify your investments across a wide range of assets. Look for funds managed by experienced professionals with a proven track record. During a recession, actively managed funds that focus on value investing or have a defensive strategy can outperform the market. Carefully review the fund’s performance history, expenses, and investment philosophy before making a decision.

7. Maintain a Long-Term Perspective

It is essential to remember that recessions are temporary, and the economy eventually recovers. Therefore, it is crucial to maintain a long-term perspective when investing during a recession. Avoid making impulsive decisions based on short-term market fluctuations. Stick to your investment plan and remain focused on your long-term financial goals.

8. Seek Professional Advice

Investing during a recession can be challenging, especially for novice investors. Consider seeking advice from a qualified financial advisor who can provide customized guidance based on your unique financial situation and risk tolerance. A professional can help you navigate the complexities of the market and make informed investment decisions.

9. Stay Informed and Adapt

The economic landscape is constantly evolving, especially during a recession. Stay informed about market trends, government policies, and industry developments that can impact your investments. Be prepared to adapt your investment strategy as the situation changes. Flexibility and staying updated are key to maximizing your investment opportunities during a recession.

10. Embrace Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach ensures that you buy more shares when prices are low and fewer shares when prices are high. During a recession, this strategy can help you take advantage of market downturns by acquiring more shares at lower prices over time.

In conclusion, investing during a recession requires careful planning, diversification, and a long-term perspective. By implementing these strategies and staying informed, you can position yourself for success and potentially achieve significant returns on your investments in 2023.