12 ways to invest your money Investing, Money management, Money strategy from www.pinterest.com

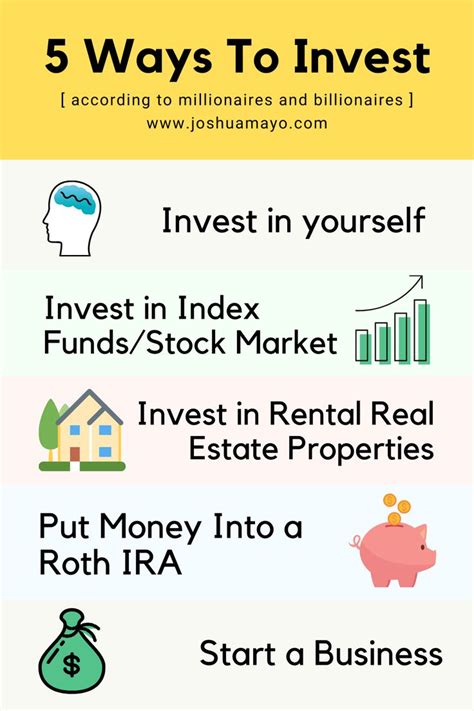

Investing money is a crucial step towards financial security and achieving long-term goals. With the right approach, investing can help grow your wealth over time. In this article, we will explore various ways to invest money in 2023 and highlight their potential benefits and risks.

Stock Market

Investing in the stock market remains one of the most popular ways to grow wealth. By buying shares of publicly traded companies, investors can participate in their success and potentially earn dividends and capital gains. However, it is important to conduct thorough research and understand the risks involved.

Real Estate

Real estate investment provides an opportunity to generate passive income through rental properties or capital appreciation. Whether investing in residential or commercial properties, it is crucial to evaluate market conditions, location, and potential returns before making any decisions.

Bonds

Bonds are fixed-income securities that offer regular interest payments and return the principal amount at maturity. They are considered less risky than stocks and can provide stability to an investment portfolio. Government bonds, corporate bonds, and municipal bonds are popular options to consider.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who aim to maximize returns while minimizing risks. Mutual funds provide an opportunity for individuals with limited knowledge to benefit from expert management.

Exchange-Traded Funds (ETFs)

Similar to mutual funds, ETFs also offer diversification but trade like individual stocks on the stock exchange. They provide easy access to a broad range of asset classes, sectors, or even specific strategies. ETFs are a cost-effective way to invest in a particular market or industry.

Commodities

Investing in commodities such as gold, silver, oil, or agricultural products can offer a hedge against inflation and diversification. Commodities can be traded through futures contracts, exchange-traded funds, or even physical ownership. However, it requires a good understanding of market dynamics and careful risk management.

Cryptocurrencies

Digital currencies like Bitcoin and Ethereum have gained significant popularity in recent years. While highly volatile, cryptocurrencies offer potential high returns. However, it is important to thoroughly research and understand the technology, market trends, and associated risks before investing in cryptocurrencies.

Peer-to-Peer Lending

Peer-to-peer lending platforms allow individuals to lend money to others directly, bypassing traditional banks. Investors can earn interest on their loans, while borrowers can access funds at potentially lower rates. However, it is important to evaluate the creditworthiness of borrowers and diversify investments to mitigate risks.

Startups and Venture Capital

Investing in startups can be highly rewarding but comes with significant risks. By providing capital to early-stage companies with high growth potential, investors can benefit from substantial returns if the company succeeds. However, due diligence is crucial, and only a small portion of the investment portfolio should be allocated to startups.

Conclusion

Investing money is a personal decision that should align with your financial goals, risk tolerance, and time horizon. Diversification, thorough research, and staying updated with market trends are key to successful investing. Consider consulting with a financial advisor to develop a strategy that suits your needs and maximizes your chances of achieving long-term financial success.