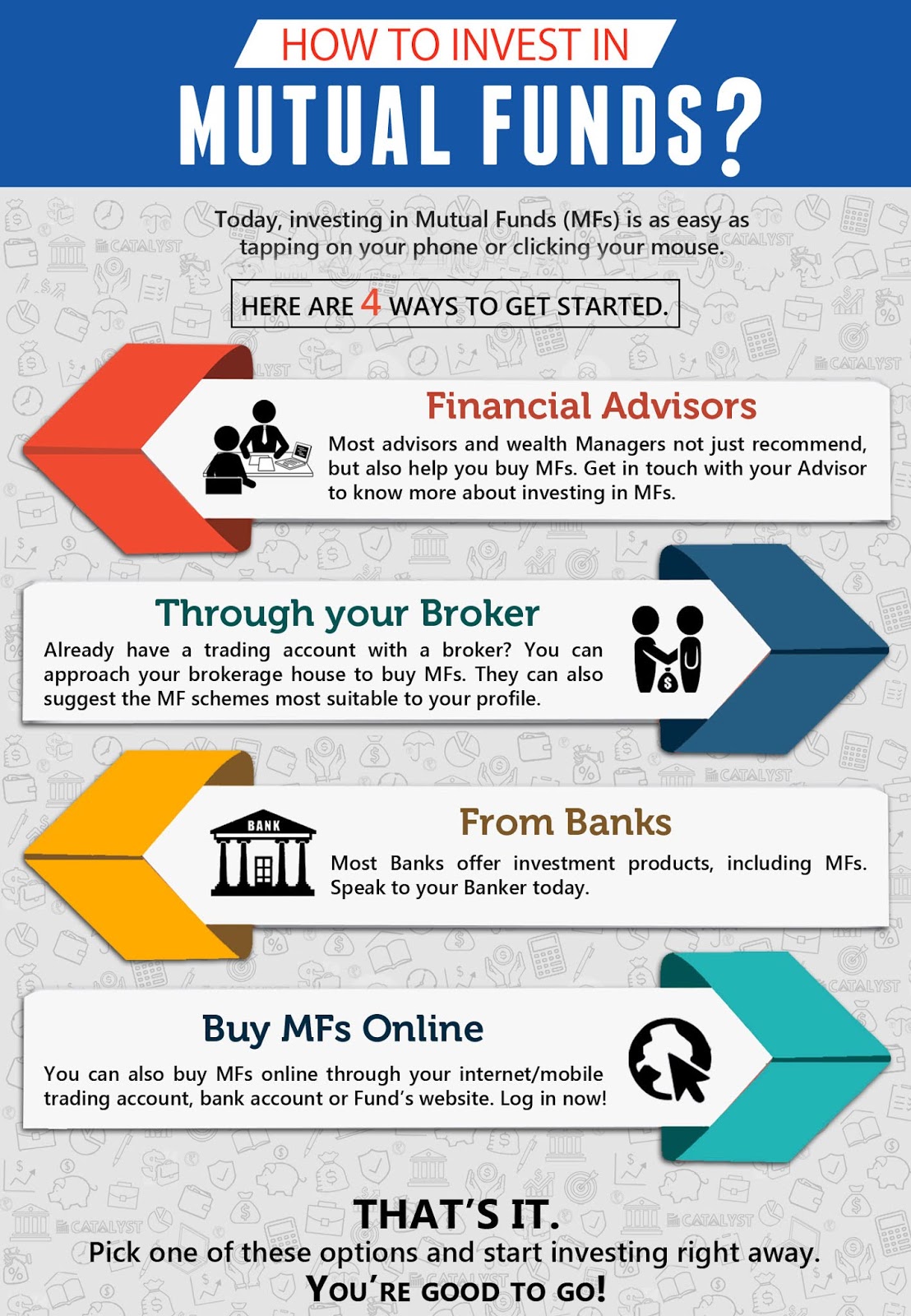

How to invest in Mutual Funds?……by FinVise India from finvise.blogspot.com

Mutual funds have become an increasingly popular investment option for individuals looking to grow their wealth. With a wide range of funds available, it can be overwhelming to determine the best way to invest in mutual funds. In this article, we will discuss some strategies and tips to help you make informed investment decisions and maximize your returns.

Do Your Research

Before investing in mutual funds, it is crucial to thoroughly research the different types of funds available. Consider factors such as the fund’s investment objective, historical performance, and expense ratio. Look for funds that align with your financial goals and risk tolerance.

Understand Your Risk Tolerance

Investing in mutual funds involves a certain level of risk. It is essential to understand your risk tolerance before investing. If you have a low tolerance for risk, consider investing in conservative funds that focus on capital preservation. On the other hand, if you have a higher risk tolerance, you may be comfortable investing in more aggressive funds that offer the potential for higher returns.

Diversify Your Portfolio

One of the key principles of investing is diversification. By spreading your investments across different asset classes, industries, and regions, you can reduce the impact of any single investment on your portfolio. Diversification helps to minimize risk and potentially increase returns. Consider investing in a mix of equity funds, bond funds, and international funds to achieve a well-diversified portfolio.

Consider Your Investment Horizon

When investing in mutual funds, it is important to consider your investment horizon. If you have a longer time horizon, you may be able to take on more risk and invest in funds with higher growth potential. However, if you have a shorter time horizon, it may be more prudent to invest in funds that focus on capital preservation and income generation.

Invest Regularly

One of the best ways to invest in mutual funds is to invest regularly through a systematic investment plan (SIP). By investing a fixed amount at regular intervals, you can take advantage of the power of compounding and reduce the impact of market volatility. SIPs also help inculcate a disciplined approach to investing.

Monitor Your Investments

Once you have invested in mutual funds, it is important to regularly monitor your investments. Keep track of the fund’s performance, review your portfolio’s asset allocation, and make adjustments as necessary. Stay informed about market trends and economic indicators that may impact your investments.

Consult a Financial Advisor

If you are new to investing or find it challenging to navigate the world of mutual funds, it may be beneficial to seek the advice of a financial advisor. A qualified advisor can help you evaluate your financial goals, assess your risk tolerance, and recommend suitable funds based on your individual circumstances.

Review and Rebalance Your Portfolio

As your financial goals and circumstances change, it is important to periodically review and rebalance your portfolio. Rebalance your investments to maintain your desired asset allocation and ensure that your investment strategy remains aligned with your goals. Consult with a financial advisor if you require assistance in rebalancing your portfolio.

Stay Informed

Finally, stay informed about the latest developments in the mutual fund industry. Subscribe to financial publications, attend seminars, and leverage online resources to enhance your knowledge and understanding of mutual funds. The more informed you are, the better equipped you will be to make sound investment decisions.

Conclusion

Investing in mutual funds can be a lucrative way to grow your wealth over time. By doing thorough research, understanding your risk tolerance, diversifying your portfolio, and staying informed, you can optimize your mutual fund investments. Remember to consult with a financial advisor and regularly monitor and rebalance your portfolio to ensure that your investments remain aligned with your financial goals.